The prospect of a COVID-19 vaccine is exciting to most, but also presents challenges for employers. Employers may be considering whether vaccination will be encouraged or mandated. This article provides a general informational overview of considerations for employers. Click here to learn about the guidelines from both OSHA and EEOC.

1 min read

COVID-19 Vaccine Considerations for Employers

By Cornerstone Group on Dec 28, 2020 3:00:00 PM

1 min read

2020 Employer Health Benefits Survey Results

By Cornerstone Group on Oct 21, 2020 11:10:53 AM

Employer-sponsored healthcare costs top $21k a year

Each year, the Kaiser Family Foundation conducts a survey to examine employer-sponsored health benefit trends in areas such as premiums, employee contributions and plan enrollment.

Click here to read a summary of the main takeaways from the 2020 survey.

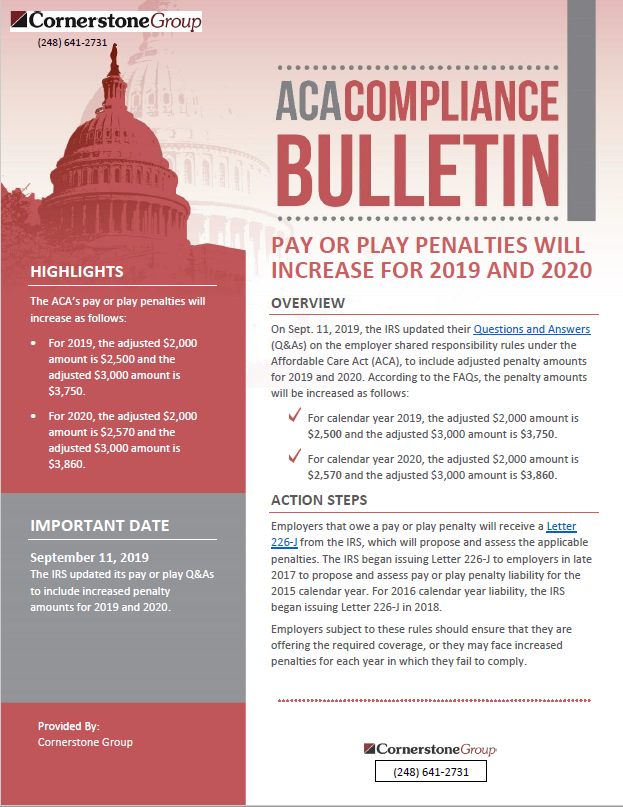

Pay or Play Penalties Will Increase for 2019 and 2020

By Cornerstone Group on Sep 19, 2019 4:54:00 PM

On Sept. 11, 2019, the IRS updated their Q&As on the ACA's employer shared responsibility rules to include adjusted penalty amounts for 2019 and 2020.

1 min read

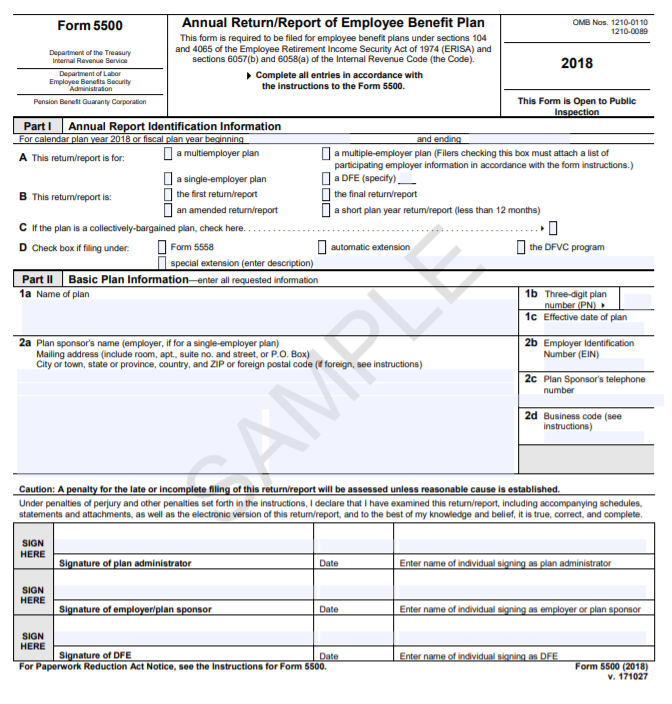

Form 5500 Is Due by July 31 for Calendar Year Plans

By Cornerstone Group on Jul 1, 2019 10:00:00 AM

Employers with employee benefit plans that operate on a calendar year basis must file their Forms 5500 with the DOL by July 31. An employer may extend this deadline by two and one-half months (until Oct. 15) by filing IRS Form 5558. This Compliance Bulletin summarizes the Form 5500 filing requirement and highlights the deadlines for calendar year plans.

Read the compliance bulletin now or you may have to pay up to $2,194 per day for each day you do not have the Form 5500 completed!

Click here to view the compliance bulletin.

1 min read

Everything You Need To Know About Paid Time Off (PTO)

By Cornerstone Group on May 3, 2019 11:48:52 AM

Offering employees time off from work can be an easy way to round out your benefits package. When taken advantage of, paid time off (PTO) can bring employees back into the workplace with renewed energy and productivity. Moreover, workers want flexibility in the workplace and want to find a healthy work-life balance. A well-drafted PTO policy can show your commitment to employee wellness and help keep your workforce happy.

Michigan Paid Medical Leave Takes Effect March 29th 2019

By Cornerstone Group on Apr 5, 2019 9:57:02 AM

Beginning March 29, 2019, Michigan employers with 50 or more employees must provide paid medical leave to their eligible employees under the Paid Medical Leave Act (PMLA). Click here to view the Compliance Bulletin.

2019 Survey Results

By Cornerstone Group on Apr 1, 2019 2:39:59 PM

Click here for the 2019 Employee Benefit Survey Results! View data on what other businesses in your area and industry are offering, and identify your plan's strengths and weaknesses in order to fortify your recruitment and retention efforts.

IRS Issues Letter 5699 To Noncompliant Employers

By Jessica Rowland on Oct 3, 2018 9:31:01 AM

The Internal Revenue Service has been sending Letter 5699 to employers that have not complied with their ACA reporting requirements under Internal Revenue Code Section 6056 for the 2015 calendar year.

Affordability Percentages Will Increase For 2019

By Jessica Rowland on May 23, 2018 11:55:37 AM

On May 21, 2018, the IRS issued Revenue Procedure 2018-34 to index the contribution percentages in 2019 for purposes of determining affordability of an employer’s plan under the Affordable Care Act. These updated affordability percentages are effective for taxable years and plan years beginning Jan. 1, 2019. This is a significant increase from the affordability contribution percentages for 2018. As a result, some employers may have additional flexibility with respect to their employee contributions for 2019 to meet the adjusted percentage.

IRS Issues New Tools for 2018 Tax Withholding

By Jessica Rowland on Mar 12, 2018 2:32:48 PM

HIGHLIGHTS

- The IRS has issued three new tools for 2018 tax withholding.

- The updates reflect changes made by a tax reform law enacted in 2017.

- Employers must use the new tables but do not have to use the new Form W-4 for 2018.

- An updated calculator allows taxpayers to check withholdings.

Click here to view the full article

-1.jpg)